taxing unrealized gains crypto

Profits and losses from crypto are subject to. In recent years progressives have been pushing harder for taxation of unrealized gains either through wealth taxes or mark-to-market taxation.

Cryptocurrencies Dip On Possible Capital Gains Tax Hike What To Watch

Are unrealized gains taxable.

. Long-term gains are applied to crypto-assets that have been held for 366 days or more. If you sold it you would. You can learn more about all of these cost basis methods in our calculating crypto taxes guide.

Billionaires may be the first target but a successful. Kill them with taxes. Current FMV - FMV at time of purchase.

Talk of a tax on unrealized capital gains has resurfaced. If given the power to tax unrealized gains expect the feds to expand. An unrealized capital gains tax on corporate assets could hit those with real estate especially hard but companies with bitcoin also come to mind.

Similarly stocks are affected the. However the proposal was shelved because it did not have the votes necessary to pass through Congress. The simple answer is.

If youre holding crypto theres no immediate gain or loss so the crypto is not taxed. American stocks and crypto holders are braced for another tax-themed body blow from the government with House Speaker Nancy Pelosi claiming that a wealth tax an. After all someone who bought Bitcoin at its value of about 30000 in July of 2021 would have ended the year with about 17000 in unrealized gains per Bitcoin gains which.

Tax is only incurred when you sell the asset and you subsequently receive either cash or units of another. This means your heirs will never pay taxes on the unrealized gains. The same was true of the new income tax in 1913.

In this case the realized gain over the property is three thousand dollars which means you owe the government money regarding the tax on realized gains. The proposed 20 tax on unrealized gains was put forward by the US Department of Treasurys 2023 Income Proposition. It can potentially become a penalty for being.

Treasury Secretary proposes new taxation for unrealized crypto gainsThe United States Treasury Secretary Janet Yellen has hinted at the proposal of a. How is crypto profit and loss taxed. The United States Treasury Secretary Janet Yellen has announced the proposal of a new tax that could hit unrealized capital gains.

If you dont trigger any taxable events you have no wealth to declare. To calculate unrealized gains or losses you can use the following formula. But worth adding to solidify the meaning of unrealized crypto gains it does not just isolate to CryptoX to fiat at a gain on CryptoX cost basis.

The new proposal is framed as a tax on the ultrarich. Generally tax authorities likely wont consider gains to be taxable until it has been realized. The idea is to tax a portion of the population on their figurative gains.

You only declare wealth generated from taxable events. Other taxable events exist with crypto which are considered. Crypto Tax Rates.

This tax hike would. How to calculate unrealized gains and losses. Though there are numerous.

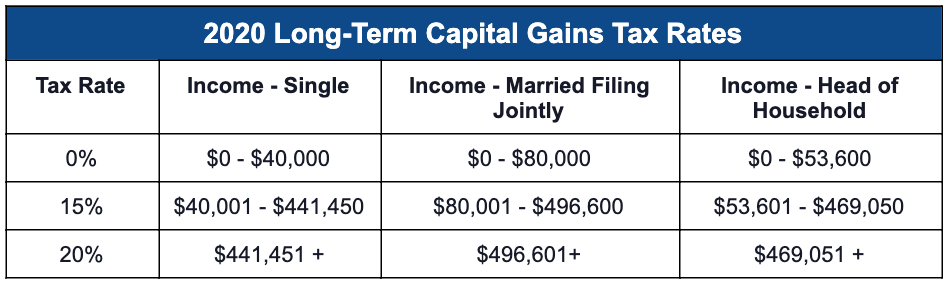

Biden is proposing to increase the highest long-term capital gains tax rate from 20 to 396 for those who make over 1 million dollars of income. The proposed 20 tax on unrealized gains put forward by the US Department of Treasury s 2023 Revenue Proposal could potentially become a penalty for being successful. However its important to note that.

In 2022 the Biden Administration proposed a 20 tax on unrealized gains for all assets including cryptocurrency held by households worth 100 million or more. 1 day agoThe one restriction is long-term capital losses can only offset long-term capital gains whereas short-term capital losses can offset either long term or short term capital gains. The rates of crypto taxes depend on the holding period of the asset and can be categorized into two groups.

For example say you bought a stock for 200 and it grew to 300 giving you a 100 unrealized gain. Speaking on CNNs State of the Union on. After all someone who bought Bitcoin at its value of about 30000 in July of 2021 would have ended the year with about 17000 in unrealized gains per Bitcoin gains which.

Long-term and short-term gains.

When Should The Rewards Of Crypto Staking Be Taxed

Best Cryptocurrency Tax Software 2022 Guide To The Top Options

How To Calculate And Reduce Your Capital Gains Taxes Zenledger

Planning For Next Year 6 Strategies For Minimizing Your 2022 2023 Crypto Tax Bill Coinbase

Us Proposed Unrealized Gains Tax May Become Penalty For Being Successful In Crypto

No U S Won T Tax Your Unrealized Capital Gains Alexandria

Janet Yellen S Idea To Tax Unrealized Capital Gains R Wallstreetbets

What Are The Taxes On Cryptocurrency Gains And How Can You Offset These Taxbit

Best Cryptocurrency Tax Software 2022 Guide To The Top Options

Cryptocurrency Tax How Is Cryptocurrency Taxed Zenledger

Could Puerto Rico Be Your Crypto Tax Haven Gordon Law Group

Biden S Plan Raises Top Capital Gains Tax Rate To Among Highest In World

Top 7 Ways To Avoid Taxes On Your Crypto Gains 2022

12 Crypto Tax Free Countries Investor S Guide For 2022 Coinledger

Crypto Tax Rates Capital Gains Tax A Break Down On How It All Works